Is Your Franchise Accreditation Up To Date?

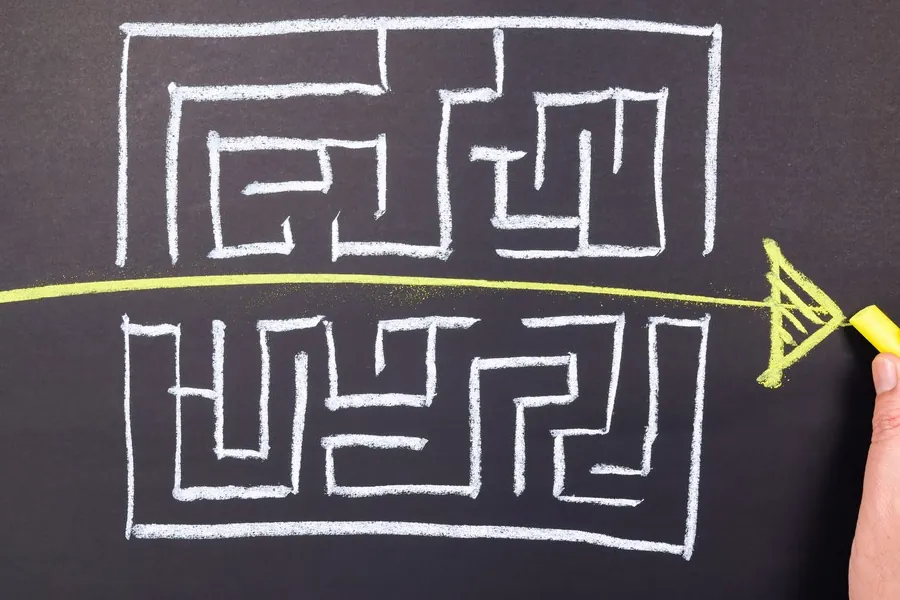

Funding is the lifeblood of the franchise sector, fuelling expansion, innovation, and success. However, navigating the labyrinth of financial institutions can be a daunting task for both franchisors and franchisees alike. Enter CFI Finance, where accreditation opens doors to streamlined funding solutions tailored for the unique needs of franchised businesses.

Keeping your accreditation up to date can offer significant benefits to your existing and potential franchisees. It can also mean streamlined access to higher funding amounts!

Why Get Accredited With CFI?

1. Grow Your Network Faster

Access to funding is often the bottleneck hindering network growth. By partnering with CFI, franchisors can supercharge their expansion initiatives. Accredited brands enjoy unparalleled approval rates and a suite of services designed to drive network growth.

2. Maintain Onboarding Momentum

In the fast-paced world of franchising, time is of the essence. Waiting months for traditional lenders’ approvals can stifle momentum and jeopardise deals. CFI’s swift approval process, often within 48 hours, keeps the onboarding process moving forward smoothly, ensuring both franchisors and franchisees stay motivated and engaged.

3. Remove Barriers For Refurbishments

Keeping franchise locations fresh and modern is essential for maintaining brand consistency and appeal. However, refurbishment financing can be challenging to secure. CFI specialises in refurbishment finance, offering manageable weekly payment plans that alleviate the burden on franchisees and ensure brand standards are upheld.

4. Increase Multi-site Franchisees

Many franchisees aspire to expand their footprint, but traditional lenders may not always share their vision. CFI takes a different approach, assessing applications based on commercial merit rather than solely relying on residential real estate. This approach empowers existing franchisees to pursue multi-site ownership and fuel network expansion.

5. Painless Equipment Rollouts

Introducing new equipment or technology across a franchise network can encounter resistance from franchisees. CFI streamlines the process with blanket approval criteria and simple documentation, breaking down upfront costs into affordable weekly payments that facilitate widespread adoption.

Update Or Start Your Accreditation

The accreditation process with CFI is straightforward:

Step 1 – Apply Online

Complete a simple online application and upload required documents, including the Franchise Disclosure Document, financials, and equipment lists.

Step 2 – Assessment & Consultation

CFI’s Credit Team will review your submission and tailor funding parameters to your franchise brand’s unique needs. Consultation ensures the right funding products and approval amounts are in place, balancing borrowing power with cash-flow considerations.

Step 3 – Rollout

Upon accreditation, franchisees can leverage CFI’s financing solutions. Customised communications and collateral support the rollout, with ongoing support from a dedicated relationship manager.

In a competitive landscape where access to funding can make or break a franchise’s success, accreditation with CFI Finance offers a distinct advantage. From turbocharging network growth to simplifying equipment rollouts, CFI’s tailored financing solutions empower franchisors and franchisees to thrive.

If your accreditation isn’t up to date just click here to get started. If you haven’t yet experienced the benefits of a CFI accreditation you can contact one of our franchise finance specialists for more information, or just click here to get it done.

Start your accreditation journey today and unlock the full potential of your franchise brand with CFI Finance.

How can we help?

Request a call-back

Let us know how and when you'd like to be contacted and one of our lending specialists will contact you at a time that's convenient.

Give us a call

Ready to chat now? Just Call 0800 456 687 and talk to one of our friendly team.

Have a question

Check out our Frequently Asked Questions with answer to the queries we get most often.